Scholar mortgage debtors who’re entitled to debt forgiveness however haven’t been in a position to get it underneath the Trump administration might face an “huge tax legal responsibility,” the American Federation of Trainer stated in a brand new courtroom doc.

The instructor’s union, which represents some 1.8 million members, launched its authorized problem in opposition to the U.S. Division of Schooling in March, and is now looking for class motion standing.

The AFT has stated Trump officers are denying debtors entry to pupil mortgage forgiveness applications, together with income-driven reimbursement plans, or IDRs. These plans tie a borrower’s month-to-month invoice to their earnings and result in debt cancellation after a sure interval.

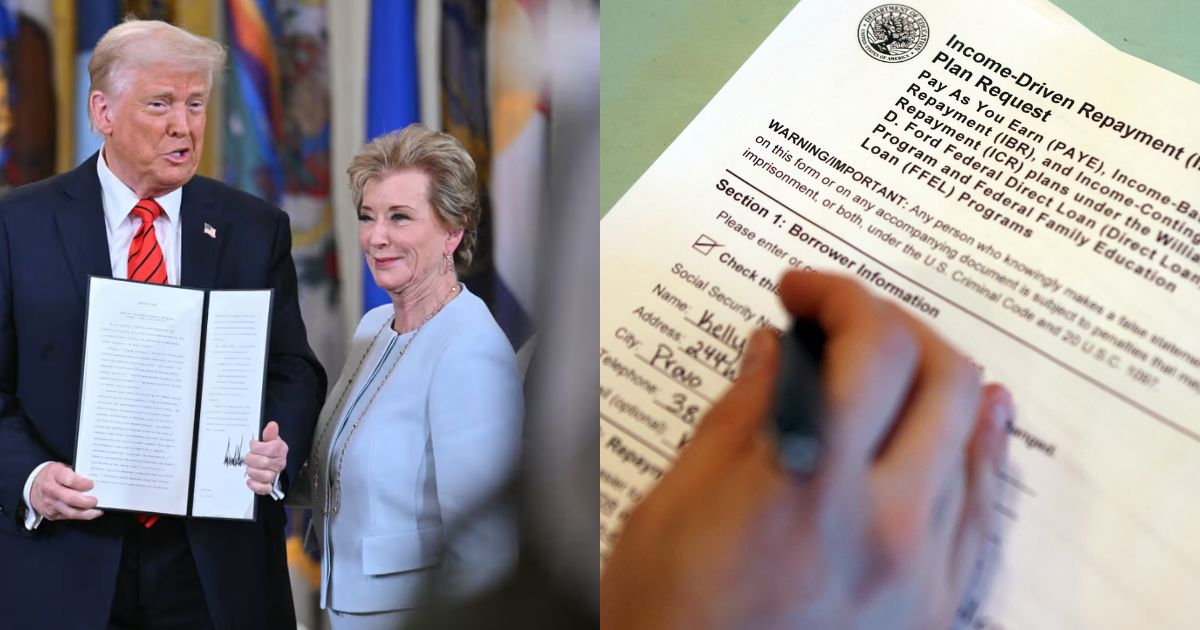

Schooling Linda McMahon stated in a submitting on Monday that greater than 1,000,000 purposes for IDR plans stay unprocessed.

And the backlog for the Public Service Mortgage Forgiveness credit score continues to develop, impacting public service employees who had been unable to get the monetary assist attributable to deferment or a interval of forbearance.

The unique IDR backlog stood at round 2 million purposes earlier within the spring, and the present quantity falls at 1,076,266 purposes. Greater than 300,000 purposes had been processed in August.

Extra from Private Finance:

Social Safety cost-of-living adjustment could also be barely larger in 2026

Some jobs might not qualify for the ‘no tax on suggestions’ coverage

Trump administration to warn households about pupil debt dangers

″[A]ny borrower who’s at present eligible to have their loans cancelled underneath an IDR plan, equivalent to IBR, however whose cancellation is being withheld by the Division, dangers this cancellation being taxed as federal earnings if the cancellation isn’t processed earlier than January 1, 2026,” the submitting reads.

The U.S. Division of Schooling didn’t reply to a request for a remark.

Right here’s what debtors have to know.

Scholar mortgage forgiveness is taxable once more quickly

A regulation that shielded pupil mortgage forgiveness from taxation is expiring this 12 months.

The American Rescue Plan Act of 2021 made pupil mortgage forgiveness tax-free on the federal stage by the top of 2025. President Donald Trump’s “huge lovely invoice” didn’t prolong or make everlasting that broader provision.

With out motion from Congress, pupil mortgage debtors who get their debt forgiven underneath the U.S. Division of Schooling’s income-driven reimbursement plans, or IDRs, would face a federal tax invoice once more beginning in 2026. IDR plans cap folks’s month-to-month funds at a share of their discretionary earnings and cancel any remaining debt after a sure interval, usually 20 years or 25 years.

Even underneath present regulation, debtors might face a state tax invoice relying on the place they dwell.

Greater than 42 million Individuals maintain a collective $1.7 trillion in pupil mortgage debt.

Whereas the Division of Schooling provides a number of income-driven reimbursement choices to assist decrease debtors’ debt balances, the company has been working to repair its backlog for a number of months now.

On the similar time, delays in forgiveness

As time runs out for pupil mortgage forgiveness to be tax-free on the federal stage, a whole lot of 1000’s of debtors who’ve requested to be enrolled in a reimbursement plan that results in debt cancellation are caught in limbo underneath the Trump administration.

In response to courtroom information, as of July 31, greater than 1.3 million debtors are caught in a backlog of IDR plan purposes. In the meantime, 72,730 individuals are ready for a willpower on their Public Service Mortgage Forgiveness standing. PSLF results in mortgage forgiveness after a decade for public servants and sure non-profit employees.

Until the U.S. Division of Schooling “acts shortly” to forgive the debt of eligible debtors, they “may face vital tax payments on debt aid that ought to have been granted to them with out penalty,” lawmakers, together with Sen. Bernie Sanders, I-Vt., just lately wrote in a letter to Schooling Secretary Linda McMahon.

Mortgage forgiveness tax legal responsibility might be vital

The tax invoice on pupil mortgage forgiveness might be substantial.

The typical mortgage stability for debtors enrolled in an IDR plan is round $57,000, larger training skilled Mark Kantrowitz just lately informed CNBC.

For these within the 22% tax bracket, having that quantity forgiven would set off a tax burden of greater than $12,000, Kantrowitz estimated. Decrease earners, or these within the 12% tax bracket, would nonetheless owe round $7,000.

Extra debtors may be on the hook for state taxes. Many states mirror the federal authorities’s tax coverage on pupil loans, which means extra states might begin to levy the help subsequent 12 months as nicely, consultants say.

Debt aid granted underneath the Public Service Mortgage Forgiveness program isn’t topic to federal taxes, though debtors might owe their state a invoice.

Many debtors have been ready six months or longer for a choice, in line with Forbes, and different publications reported that the Schooling Division was planning to reject greater than 400,000 IRD purposes because the SAVE plan continues to be blocked by authorized challenges.

The variety of PSLF purposes has surged to 74,510, up from 72,730 final month. In April, there have been lower than 50,000 purposes pending.

On the present charge of procession, it might take the division greater than 13 months to get by the complete backlog.

What to do in regards to the attainable tax invoice

Debtors who anticipate they’ll develop into eligible for pupil mortgage forgiveness in 2025 “ought to save all fee information with their servicers,” stated Nancy Nierman, assistant director of the Schooling Debt Shopper Help Program in New York.

“If obligatory, they will use this data to show they had been entitled to forgiveness throughout a 12 months by which it’s not topic to tax,” Nierman stated.

For debtors who anticipate the aid after Jan. 1, 2026, Nierman recommends beginning to plan for the tax invoice by salting away some cash when you possibly can in preparation.

Debtors typically don’t should pay the complete tax invoice in a single sum, she added.

This mess began when the Trump administration basically hit the panic button and froze all IDR purposes earlier this 12 months,” Michael Ryan, a finance skilled and the founding father of MichaelRyanMoney.com, informed Newsweek. “Their excuse? They wanted to ‘replace the system’ due to ongoing courtroom challenges to the SAVE plan. They threw the infant out with the bathwater, blocking purposes for applications that weren’t even underneath authorized problem.”

The American Federation of Academics beforehand sued the Schooling Division in March in spite of everything IDR purposes had been paused, alleging that the shutdown illegally disadvantaged debtors from gaining pupil mortgage forgiveness underneath IDR and PSLF.

“Though the Division started to course of pending IDR purposes after this case was filed, the sluggish charge of processing and the dearth of transparency with respect as to whether processed purposes are being accurately authorised or denied don’t meaningfully handle the fact that debtors are nonetheless being denied their statutory rights to reasonably priced fee plans and to debt cancellation,” the AFT stated in an amended grievance final week.

“They will request a plan by the IRS to unfold the funds over an extended time period,” Nierman stated. In the meantime, in case your liabilities exceed your belongings otherwise you’re coping with a critical monetary hardship, you could possibly scale back or eradicate the invoice altogether, she stated.

The Biden administration did not course of income-driven reimbursement purposes for debtors for months, artificially masking rising delinquency and default charges and promising unlawful pupil mortgage forgiveness to win factors with voters. The Trump administration is actively working with federal pupil mortgage servicers and hopes to clear the Biden backlog over the subsequent few months.”

The notion that the rising variety of backlogged purposes is slowing is of little consolation to pupil mortgage debtors looking for a reimbursement plan. What the present administration appears to dismiss is that these college students borrowed cash not solely based mostly on the panorama confronted when borrowing, but additionally on what was introduced as their then-current choices for future reasonably priced reimbursement and pathways to forgiveness. If now we have determined pupil mortgage reimbursement wants to vary, then it ought to change for present debtors, not previous debtors.

Whereas processing for income-driven reimbursement plan purposes has slowly elevated, there nonetheless stay greater than 1,000,000 submissions within the pipeline, to not point out further entries for different mortgage forgiveness applications. The fixed authorized back-and-forth on the validity of a few of these plans has paused processing a number of instances, and now, additional authorized motion might be triggered if the remaining claims aren’t swiftly dealt with.

These are debtors who performed by the foundations, selected public service careers, and trusted the federal government’s promise of mortgage forgiveness. Now they’re paying the worth for administrative incompetence and political gamesmanship